Beef vs Chicken Exports

When it comes to the global meat industry, two products dominate the market — beef and chicken. Exporters across the world often face a strategic question: Which one offers better profit margins? Understanding the dynamics between beef vs chicken exports helps businesses make informed decisions, optimize their logistics, and capture new market opportunities.

In this guide, we’ll compare production costs, demand trends, regulatory aspects, and profit potential between the two.

Global Demand Overview

Beef Exports

Beef is considered a premium protein, with high demand in developed economies. Countries like Brazil, Australia, and United States lead the export market. Due to its price and consumer perception, beef generates higher per-unit revenue but requires more resources to produce.

Chicken Exports

Chicken, on the other hand, is the most consumed meat globally. It’s affordable, versatile, and widely accepted in various cuisines. Export leaders include Brazil, the U.S., and Thailand. Chicken exports benefit from lower production costs and fewer trade restrictions compared to beef.

Production & Cost Structure

| Factor | Beef | Chicken |

|---|---|---|

| Feed & Rearing Time | High cost, longer growth cycle | Lower cost, faster growth cycle |

| Land & Water Requirements | Requires large space and resources | Efficient use of space and resources |

| Transportation | Heavier carcasses, costlier shipping | Lighter, easier to transport |

| Storage | Longer chilling/freezing requirements | Easier to store in bulk |

✅ Chicken has a lower cost per kg, making it easier to scale for export.

Export Pricing & Profit Margins

- Beef Average Export Price: $5.00–$8.00 per kg

- Chicken Average Export Price: $2.00–$4.00 per kg

Even though beef brings higher prices, chicken often yields better net profit margins due to:

- Cheaper production costs

- Lower shipping expenses

- Less processing waste

- Faster market turnaround

Many exporters use a mixed strategy — exporting beef for premium markets and chicken for volume-driven markets.

Regulatory & Halal Market Considerations

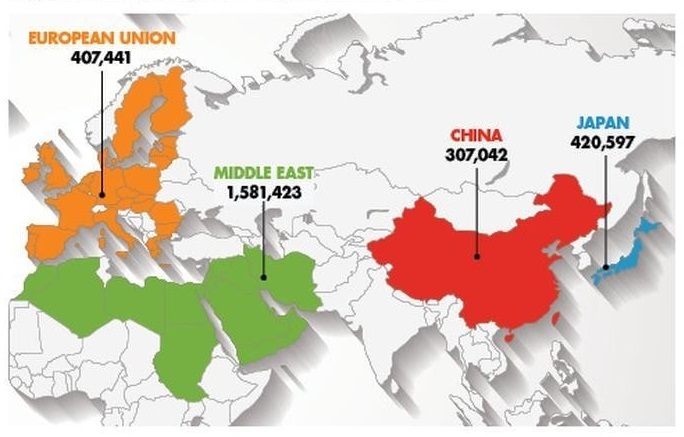

Halal certification plays a huge role in both markets, especially for exports to the Middle East, Asia, and Africa.

- Beef exports may face stricter veterinary inspections and tariff barriers.

- Chicken is easier to certify, and demand for halal chicken continues to grow rapidly.

For exporters, halal-certified chicken often provides faster approval and broader market access.

Logistics & Export Efficiency

Chicken exports offer more logistical flexibility:

- Can be shipped frozen or chilled in various cuts.

- Smaller packaging sizes allow better container utilization.

- Lower spoilage risk.

Beef requires stricter temperature controls and more expensive storage, which can reduce net profit margins.

Market Trends & Future Outlook

- Chicken is expected to dominate global protein demand over the next decade, especially in emerging markets.

- Beef will continue to hold strong in premium niche segments, particularly in the EU, China, and North America.

- Exporters investing in automation, cold chain logistics, and sustainability will see the strongest margins.

Final Verdict: Which Delivers Better Profit Margins?

| Category | Winner |

|---|---|

| Production Cost | Chicken |

| Price per Unit | Beef |

| Net Profit Margin | Chicken |

| Market Reach | Chicken |

| Certification Ease | Chicken |

Chicken exports offer better profit margins overall due to their lower production costs, lower shipping fees, and wider global market. However, beef exports remain valuable for exporters targeting high-income premium markets.

- Our Products

- Certification

- Contact Us

- About Us

- FAO Meat Market Review

- USDA Export Data

- World Halal Council

Both beef and chicken have their place in global trade, but if your goal is maximum profit margins, chicken exports lead the way. With strategic planning, halal certification, and efficient logistics, exporters can tap into a growing global demand.

For more information on how to start exporting frozen meat, contact Global Exporter BR.