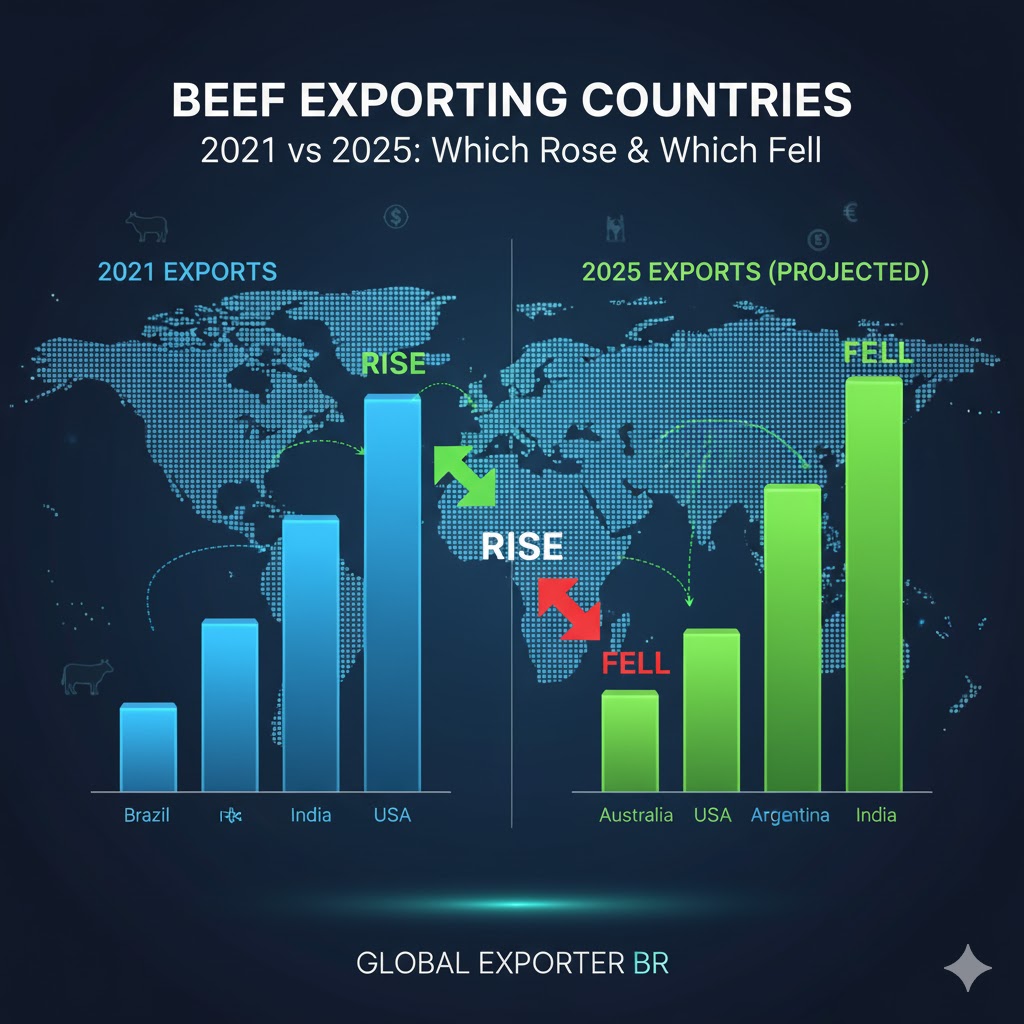

The global beef market is a dynamic beast, constantly shifting with changes in climate, trade policies, consumer demand, and even geopolitical events. For anyone involved in the meat industry, from ranchers to exporters to consumers, understanding these shifts is crucial. Today, we’re taking a deep dive into the beef exporting landscape, comparing the reality of 2021 with the projections for 2025 to see which countries are rising and which are falling in the race to feed the world’s appetite for beef.

This isn’t just about raw numbers; it’s about the stories behind them – the livestock production trends, the global trade dynamics, and the economic factors that shape this vital sector.

The Beef Exporting Titans of 2021: A Look Back

In 2021, the top beef exporting countries were largely familiar players. These nations leveraged strong cattle herds, efficient beef processing, and established trade routes to dominate the market. Key players included:

- Brazil: Often a powerhouse, Brazil consistently ranks among the largest beef exporters, benefiting from vast grazing lands and a robust industry.

- India: Surprisingly to some, India is a significant exporter, primarily of buffalo meat (carabeef), driven by a large buffalo population and specific market demands.

- USA: With a highly developed agricultural sector, the United States is a major exporter of high-quality beef, catering to premium markets worldwide.

- Australia: Known for its grass-fed beef and stringent quality standards, Australia is a key supplier, especially to Asian markets.

- Argentina: Famous for its beef culture, Argentina is another traditional heavyweight in beef exports, though its volumes can sometimes be impacted by domestic policies.

These countries collectively shaped the international beef trade in 2021, responding to post-pandemic demand fluctuations and navigating supply chain challenges.

Fast Forward to 2025: Projected Shifts and New Realities

Looking ahead to 2025, the picture is expected to change. While some giants may continue to grow, others might face headwinds, leading to shifts in their global standing. Our analysis highlights some interesting projections:

Countries Expected to See a RISE in Beef Exports by 2025:

- Brazil: Continues its upward trajectory, solidifying its position as a dominant beef exporter. Favorable land availability and ongoing investment in meat production technology are likely to fuel this growth. Expect Brazil to maintain its competitive edge in supplying various cuts to diverse markets, including increasing demand from Asia.

- India: Projections suggest continued growth, particularly in the carabeef export market. As global demand for affordable protein rises, India’s large buffalo population and processing capabilities will likely keep it a key player. Its focus on specific markets will be crucial.

- USA: The U.S. beef industry is anticipated to experience a modest rise, driven by strong domestic herds and consistent demand for its premium beef products. Innovation in sustainable beef production and targeted marketing will support this growth.

Highest Beef Exporter Country: How They Got There

Countries Expected to See a FALL in Beef Exports by 2025:

- Australia: While remaining a significant player, Australia might see a slight dip in export volumes. Factors such as climate challenges (droughts impacting herd sizes) and increasing domestic consumption could contribute to this. The focus on high-value markets will remain important.

- Argentina: Political and economic volatility can sometimes impact Argentina’s ability to consistently maximize its beef export potential. While still a major producer, its market share could face pressure if internal policies prioritize domestic supply or limit export volumes.

Best Beef Exporter in South America

What’s Driving These Changes? Key Factors in Global Beef Trade

Several interconnected factors are influencing these projected shifts in global beef exports:

- Environmental Factors & Climate Change: Droughts, floods, and other extreme weather events directly impact pastureland and cattle numbers, notably in regions like Australia and parts of South America.

- Trade Agreements & Geopolitics: New trade deals can open up markets, while tariffs or trade disputes can restrict them. Relationships with major importing nations like China, Japan, and the EU are pivotal.

- Consumer Demand & Preferences: A growing global middle class often translates to higher demand for protein, including beef. However, trends towards plant-based diets, sustainable sourcing, and specific animal welfare concerns can also influence consumption patterns.

- Disease Outbreaks: Foot-and-mouth disease (FMD) or other livestock diseases can lead to immediate bans on meat imports from affected regions, causing significant disruption.

- Currency Fluctuations: A strong local currency can make exports more expensive, impacting a country’s competitiveness in the world beef market.

- Infrastructure & Logistics: Efficient cold chain logistics, port capacity, and transportation networks are essential for timely and cost-effective beef exports.

The Road Ahead: Navigating the Global Beef Market

For industry stakeholders, understanding these beef market trends is essential for strategic planning. The future of beef exports will undoubtedly be shaped by a continuous interplay of agricultural capacity, economic policies, environmental realities, and evolving global tastes. Keep an eye on these key players as the international beef trade continues to evolve!