Brazil: the largest chicken exporter in the world

When people ask “who is the largest chicken exporter in the world?” the short, evidence-backed answer in 2024–2025 is Brazil. Brazil exported a record volume of chicken meat in 2024 and accounted for well over a third of global chicken trade — a dominant market share that reshaped global poultry flows. This article explains the numbers, the market shares, the top destinations, the companies behind the trade, and the risks that could alter the picture. S&P Global+1

1) Quick data snapshot (most important facts)

-

2024 Brazilian chicken export volume: ~5.29 million metric tons (record). S&P Global

-

2024 Brazilian chicken export value: roughly US$9.9–10.0 billion, making Brazil the global leader by value as well. Reuters+1

-

Global market share: USDA analysis projects Brazil will account for roughly 35–36% of world chicken meat exports in 2025. USDA Apps

-

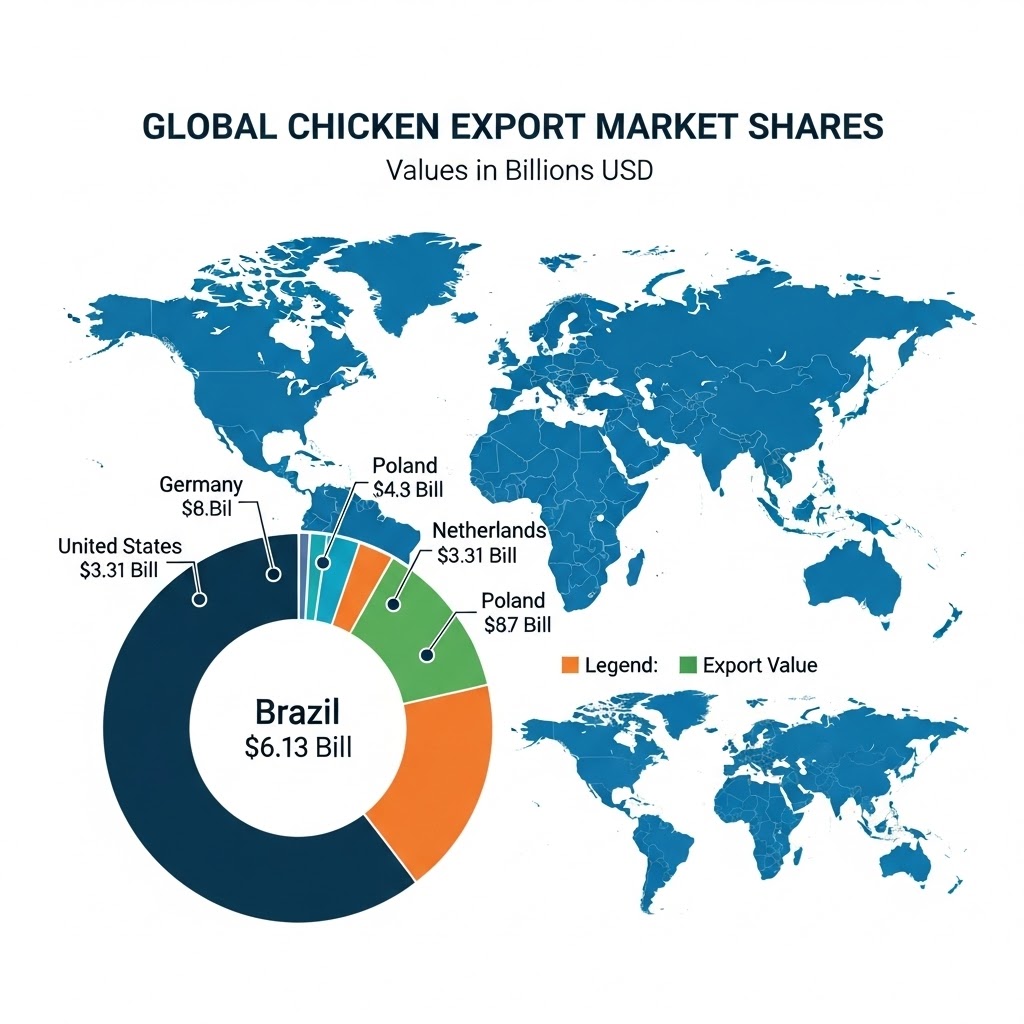

Other major exporters: United States, European Union (Netherlands, Poland, Belgium), Thailand, and China (growing exporters in recent years). ReportLinker+1

These load-bearing facts are supported by trade data and industry reports and form the basis for the rest of this article.

2) How Brazil grew to be the world’s largest chicken exporter

Brazil’s leadership is not an accident — it’s structural. Several factors combined over decades to create a cost-competitive, export-oriented poultry industry:

Scale & efficiency

Brazil has invested massively in integrated broiler production (vertical integration from feed to processing) and in processing capacity able to handle very large shipments. Large plants, standardized processes and high throughput lowered unit costs and increased export readiness. ReportLinker

Competitive feed & input costs

Abundant agricultural production (soy and corn) gives Brazilian poultry producers feed cost advantages versus many peers, lowering the cost of producing chicken meat. This is a classic comparative advantage that supports large export volumes. FAS USDA

Aggressive market development

Brazilian exporters and industry associations (notably ABPA and major integrators like JBS, BRF and Seara) actively developed markets in Asia, the Middle East and Africa, securing long-term contracts and diversified buyer bases. China, UAE, Japan and Saudi Arabia are top buyers. S&P Global+1

Cold chain & logistics

Investments in cold storage, refrigerated shipping capacity and export logistics made it practical to ship frozen chicken globally with consistent quality. That operational reliability is a major reason importers choose Brazilian suppliers. S&P Global

3) Volume and value — the detailed numbers

Multiple independent sources (national statistical offices, USDA, trade databases and industry groups) converge around Brazil’s leadership. Key figures to remember:

-

5.294 million metric tons of chicken meat exported in 2024 (Brazilian Animal Protein Association / industry compilations). S&P Global

-

~US$9.9–10.0 billion export revenue for poultry in 2024. Reuters+1

-

Per global datasets and trade aggregators, Brazil’s export volume is larger than the second-place exporter (the United States) by a significant margin. ReportLinker/Report datasets show Brazil at the top in 2023 volumes and industry updates confirm the 2024 jump. ReportLinker+1

Note: exact numbers can vary slightly depending on whether sources report fresh + frozen + prepared poultry, and whether reporting is by product code or aggregated poultry meat. The consistent signal across sources is Brazil’s clear leadership.

4) Who buys Brazil’s chicken? Top destinations

Brazil sells to a broad set of markets, which reduces reliance on any single buyer:

-

China — the single largest destination for Brazilian chicken in 2024 (hundreds of thousands of tonnes). China’s demand is pivotal. S&P Global+1

-

United Arab Emirates (UAE), Saudi Arabia, Japan, South Africa — large and consistent importers of Brazilian poultry. S&P Global

-

European Union, Mexico and other Latin American countries — also important, with EU demand increasingly tied to quality and sustainability criteria. OEC World

This geographic diversity gives Brazil resilience: if one market tightens, other demand centers can absorb volume shifts.

5) Who are the major exporting companies?

Brazil’s export strength is concentrated among large vertically-integrated groups:

-

JBS / Seara — JBS is a global meat giant with extensive poultry operations via Seara.

-

BRF — one of Brazil’s best-known poultry and pork exporters.

-

Smaller regional integrators and cooperatives — Copacol, Aurora and others — also contribute significant volumes, particularly for specific product lines (offs, feet, wings, frozen cuts). mellocommodity.com.br

Those companies combine production scale, global sales teams, and compliance (HACCP, ISO, Halal certification) to meet importers’ technical and regulatory requirements.

6) Market share: how dominant is Brazil?

Different metrics give slightly different answers (by volume, by value, by specific product categories), but the consensus is:

-

By volume: Brazil ships roughly a third or more of global chicken exports (USDA estimated ~36% market share for 2025 projections). USDA Apps

-

By value: Brazil also leads in export dollars for poultry, with nearly US$10 billion in revenue for 2024. Reuters

To put that in context: Brazil’s market share is larger than that of the United States and the EU individually, making Brazil the single largest national exporter and a pivotal supplier globally. ReportLinker+1

7) Product mix — what Brazil actually exports

Brazilian poultry exports include a broad mix:

-

Frozen chicken parts (breast, wing, leg quarters) — the largest segment for long-distance trade.

-

Whole frozen chickens — for markets that prefer whole bird imports.

-

Processed and value-added products — breaded, pre-cooked and further-processed items for foodservice and retail.

-

By-products — offals, feet and other parts with strong demand in specific regions (Asia, Africa). OEC World

Because of that diversity, Brazil can optimize shipments by destination and price points.

8) Recent events and risks that could change the ranking

Two categories of risk can shift the landscape rapidly:

(a) Animal disease outbreaks — avian influenza (AI)

Outbreaks can trigger import bans or temporary restrictions from major buyers. In 2025 Brazil recorded an outbreak on a commercial farm and some trading partners (notably China initially) imposed temporary bans — showing how a disease event can disrupt flows even for the largest exporter. Brazil’s authorities and industry associations responded with containment steps and notifications to the World Organisation for Animal Health. Reuters+1

(b) Trade policy & sustainability measures

Importers (especially the EU and some buyers in Asia) increasingly screen for deforestation-linked sourcing, carbon footprint and traceability. Regulatory or buyer policy shifts that restrict imports from certain regions or demand stricter proof of sustainable origin could affect volumes from specific producers or regions in Brazil. Industry has responded with traceability programs and zero-deforestation commitments, but these remain important risk factors. Open Knowledge FAO+1

Bottom line: Brazil is the largest exporter today, but disease events or major policy shifts can create short-term or structural changes in flows.

9) How importers evaluate Brazilian chicken suppliers

If you buy chicken internationally, here’s what importers typically check:

-

Sanitary credentials: HACCP, national veterinary clearances, and plant approvals.

-

Cold chain integrity: temperature logs, container handling and packing pictures.

-

Certifications: Halal (for many Middle East buyers), ISO, BRC and traceability evidence.

-

Sustainability & supply-chain transparency: proof of non-deforestation sourcing where required.

-

Commercial reliability: lead times, contract terms, minimum order quantities and contingency handling if shipments are delayed. USDA Apps+1

Brazilian exporters that consistently provide documentation and digital traceability score higher in procurement tenders.

10) Regional competitors and why they matter

While Brazil is top, other exporters matter in specific niches:

-

United States: large exporter of high-value cuts and processed poultry (significant in North America and parts of Asia). OEC World

-

Netherlands & Poland (EU): big suppliers to intra-EU markets and Africa; high logistics efficiency for frozen poultry. World’s Top Exports+1

-

Thailand: traditionally strong in processed poultry and niche markets in Asia. ReportLinker

-

China: growing frozen poultry exporter by value from domestic processing and export policy changes (a newer factor in global trade). World’s Top Exports

Competition keeps markets efficient and gives buyers choice if one supplier faces temporary disruptions.

11) Forecast & outlook (2025–2027)

Industry forecasts point to steady global poultry demand driven by population growth and consumers shifting from red meat to white meat in many markets. Key expectations:

-

Brazil to remain the largest exporter in the near term, assuming no sustained disease outbreaks or major trade closures. USDA and industry forecasts project Brazil’s share to stay in the mid-30% range through 2025. USDA Apps

-

Value growth may accelerate if higher-margin processed products expand in global foodservice and retail channels. wattagnet.com

-

Sustainability requirements and traceability will increase operating costs for exporters but open premium channels for compliant suppliers. Open Knowledge FAO

Importers should plan for continuity by qualifying multiple suppliers and monitoring sanitary alerts (e.g., OIE / WOAH notifications).

12) Practical guidance for buyers and traders

If you trade or import chicken, these practical steps help manage risk and secure supply:

-

Vet plant approvals: ask for plant lists, government export approvals and recent audit reports.

-

Request cold-chain evidence: temperature logger downloads, packing photos and pre-shipment checks.

-

Diversify suppliers: keep at least two origin sources (e.g., Brazil + EU or U.S.) to hedge risk.

-

Check certification scope: Halal, organic or specialty processing requirements must be verified for the shipment’s plant.

-

Monitor sanitary alerts: subscribe to OIE / local veterinary notifications for rapid response. Reuters+1

13) Where to watch for real-time updates (data sources)

Reliable public sources for ongoing export data and alerts:

-

UN Comtrade — official trade flows (product-level exports by country). comtrade.un.org

-

USDA / FAS reports — country reports and trade forecasts (e.g., Poultry & Products Annual). USDA Apps

-

Brazilian Animal Protein Association (ABPA) — industry exports and market breakdowns. S&P Global

-

Global news services (Reuters, S&P Global, WATTAgNet) — trade developments and disease incidents. Reuters+2S&P Global+2

Use these to validate volumes, prices, and immediate disruptions.

14) Summary: what the numbers mean

-

Brazil is the largest chicken exporter in the world (2024–2025) by a clear margin — roughly 5.3 million tonnes in 2024 and ~35–36% of global exports projected for 2025. S&P Global+1

-

The position is structural but not unbeatable: disease outbreaks (avian influenza), sudden trade bans, or stringent sustainability import rules could reduce shipments temporarily or shift demand. Reuters+1

-

For buyers, Brazil offers scale, competitive pricing and wide product availability — but due diligence (certifications, cold chain proof, secondary suppliers) remains essential.

-

Frozen Chicken Exporter Guide: Quality, Logistics & Best Practices https://globalexporter-br.com/frozen-chicken-exporter-guide)

-

Frozen Meat Packages: What Importers Want https://globalexporter-br.com//frozen-meat-packages)

-

How to Ensure Halal Compliance for Frozen Beef & Chicken Exports https://globalexporter-br.com/halal-compliance)

-

Brazilian Animal Protein Association / industry press (record exports 2024). S&P Global

-

USDA / FAS Poultry reports (global market shares & forecasts). USDA Apps

-

Reuters — coverage of avian influenza impact and trade reactions. Reuters

-

Worldstopexports — country export ranking and value tables. World’s Top Exports

-

ReportLinker datasets summarizing export volumes by country. ReportLinker

Frozen Chicken Wholesale: Building Supply Chains

How Exporting Frozen Chicken Breast Differs from Whole Frozen Chicken