The global food trade is powered by two major industries — the edible oil exporter network and the meat exporter market. Both sectors fuel economies and ensure food security worldwide. While they share similarities in production and global reach, their trade policies, logistics, and market regulations differ significantly. Understanding how an edible oil exporter operates compared to a meat exporter reveals key insights into international trade dynamics.

However, despite their similarities in scale and value, their trade policies, logistics frameworks, and market dynamics differ dramatically.

In this article, we’ll compare the edible oil export industry (palm oil, soybean oil, sunflower oil, olive oil, etc.) with the meat export sector (beef, chicken, and pork), analyzing how trade policies affect growth, profitability, and compliance for exporters worldwide.

1. Understanding the Core Industries

️ Edible Oil Export Industry

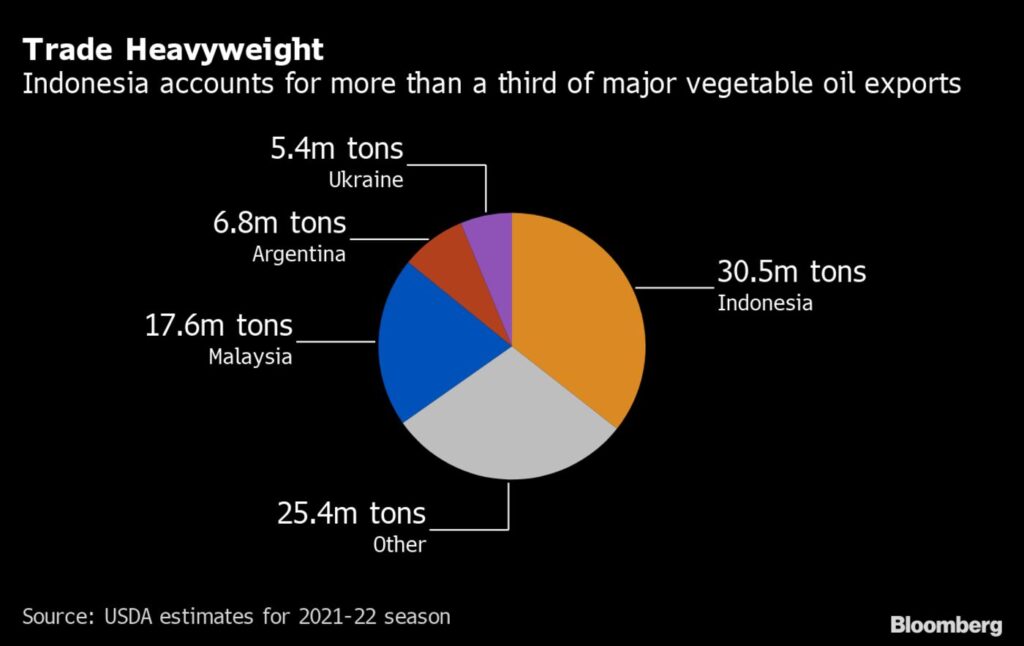

Edible oils are vital ingredients for cooking, manufacturing, and cosmetics. Major exporters include:

-

Indonesia (Palm oil)

-

Malaysia (Palm oil)

-

Brazil (Soybean oil)

-

United States (Soybean and corn oil)

-

Ukraine (Sunflower oil)

These exporters rely on large agricultural lands, efficient processing facilities, and extensive port infrastructure.

Meat Export Industry

Meat exports cover frozen and fresh beef, chicken, and pork, with top exporters like:

-

Brazil (Beef and chicken)

-

United States (Beef and pork)

-

European Union (Pork)

-

Australia (Beef and lamb)

-

New Zealand (Beef and lamb)

The meat export industry is far more regulated, with strict sanitary standards and temperature-controlled logistics requirements.

⚖️ 2. Regulatory Frameworks: Food Safety & Compliance

One of the most significant differences between an edible oil exporter and a meat exporter lies in regulatory oversight.

For Edible Oil Exporters

Edible oil exports are governed primarily by agricultural and food safety standards that focus on:

-

Pesticide residue limits

-

Genetically modified organism (GMO) labeling

-

Refining and processing safety

-

Packaging and labeling for consumer transparency

International regulations include:

-

Codex Alimentarius standards

-

ISO 22000 and HACCP for food safety management

-

RSPO Certification for sustainable palm oil

For Meat Exporters

Meat exporters face far stricter regulations due to foodborne disease risks. Key requirements include:

-

Veterinary health certificates

-

Cold-chain verification

-

Halal or Kosher certification for specific markets

-

Traceability from farm to fork

-

Sanitary and Phytosanitary (SPS) compliance under the World Trade Organization (WTO)

While edible oil trade focuses on product purity and sustainability, meat trade prioritizes biosecurity and traceability.

3. Trade Policy Differences

Trade policies for edible oil and meat exports vary in scope, taxation, and international agreements.

Edible Oil Export Policies

Many countries impose export quotas or duties to stabilize domestic supply and prices. For example:

-

restricts palm oil exports to protect domestic cooking oil prices.

-

regulates soybean oil exports via taxes to encourage local processing.

Additionally, biofuel demand has created a secondary export market for edible oils, making trade policy even more complex.

Meat Export Policies

Meat export policies center on health certification and trade access agreements. For instance:

-

and must meet strict veterinary standards to export to .

-

negotiates bilateral trade deals to expand pork and beef access in .

Unlike oils, which face price-based restrictions, meat exports are often barred or suspended temporarily due to disease outbreaks like ASF or BSE.

4. Logistics and Supply Chain Comparison

Edible Oil Export Logistics

-

Transported in bulk containers or flexitanks.

-

Shelf-stable — minimal refrigeration needed.

-

Lower logistical costs per ton.

-

Vulnerable to spillage or contamination during long-distance shipping.

Meat Export Logistics

-

Requires reefer containers with continuous temperature monitoring.

-

Shorter shelf life and higher freight costs.

-

Strict hygiene during handling and packaging.

-

Insurance coverage needed for potential spoilage.

While edible oil logistics emphasize volume efficiency, meat export logistics rely on precision cold-chain management.

5. Market Value & Profit Margins

| Parameter | Edible Oil Exporter | Meat Exporter |

|---|---|---|

| Product Shelf Life | Long (6–12 months) | Short (up to 6 months frozen) |

| Logistics Cost | Low–Medium | High |

| Value per Ton | Lower | Higher |

| Market Volatility | Price fluctuations due to crops | Disease & import restrictions |

| Certification Cost | Moderate | High |

| Entry Barriers | Low–Medium | High |

✅ Edible oil exports are scalable and capital-efficient.

✅ Meat exports yield higher profit margins but demand intensive compliance and capital investment.

6. Sustainability & Environmental Regulations

Sustainability is a major policy factor influencing both sectors.

Edible Oil

Palm and soybean oil exports face scrutiny due to deforestation and carbon emissions. Exporters are now required to:

-

Prove traceable sourcing.

-

Comply with RSPO (Roundtable on Sustainable Palm Oil) standards.

-

Implement reforestation or carbon-offset programs.

Meat

The meat industry faces challenges related to methane emissions and water consumption. Exporters are pressured to:

-

Adopt low-carbon livestock management.

-

Certify sustainable feed sources.

-

Provide documentation on animal welfare practices.

Both industries are under global pressure to become more eco-friendly and transparent.

7. Market Access and Tariff Policies

Tariff and quota barriers shape the competitiveness of both exporters.

Edible Oil Tariffs

-

Relatively stable tariffs across major importing regions.

-

Some countries impose import duties to protect local crushers.

-

Free trade agreements (FTAs) often benefit oil exporters from nations.

Meat Export Tariffs

-

High tariffs in markets like and .

-

SPS-based trade restrictions frequently limit access.

-

Tariff-rate quotas (TRQs) determine how much meat can be imported tax-free.

Meat exporters face greater tariff complexities than edible oil exporters.

8. Consumer Demand Trends

Edible Oil Market Trends

-

Increased demand for organic, cold-pressed, and non-GMO oils.

-

Growing popularity of sunflower and avocado oils for health benefits.

-

Food manufacturers prefer bulk refined oils for cost control.

Meat Market Trends

-

Rapid growth of halal and organic meat demand.

-

Preference for frozen convenience products.

-

Rising interest in plant-based meat alternatives, influencing trade forecasts.

The edible oil market follows health and price trends, while meat trade reflects cultural and ethical consumption shifts.

9. Opportunities for Exporters

Both sectors present strong export opportunities:

For Edible Oil Exporters

-

Expansion into Africa and South Asia’s growing food industries.

-

Biofuel blending mandates boosting demand for vegetable oils.

-

Value-added refined oils and branded consumer packaging.

For Meat Exporters

-

Rising middle-class demand in Asia for beef and pork.

-

Frozen meat trade growth via e-commerce and retail.

-

High demand for Halal-certified exports from , , and .

✅ Exporters who adopt technology, compliance, and logistics innovation will capture long-term global growth.

⚠️ 10. Common Challenges

| Challenge | Edible Oil Exporters | Meat Exporters |

|---|---|---|

| Price Volatility | Crop yield fluctuations | Feed & disease risks |

| Tariff Barriers | Moderate | High |

| Sustainability Compliance | RSPO, GMO labeling | Animal welfare, carbon emissions |

| Logistics | Bulk shipment safety | Reefer cold-chain management |

| Regulatory Complexity | Moderate | Very high |

| Health & Safety Issues | Product purity | Zoonotic disease control |

Both sectors demand strategic planning and compliance expertise to succeed in global markets.

11. Technology and Innovation in Exports

In Edible Oil

-

Automation in refining and packaging.

-

Blockchain traceability for sustainable sourcing.

-

Smart containers tracking temperature and contamination.

In Meat

-

AI-based cold-chain monitoring.

-

DNA traceability to verify product origin.

-

Robotics in meat processing plants.

Technological innovation is closing the gap between these industries, making both safer and more efficient.

A Tale of Two Trades

When comparing edible oil exporters and meat exporters, both serve as economic backbones for their nations — yet their trade environments differ in risk, regulation, and opportunity.

-

️ Edible oil exporters enjoy longer shelf life, lower logistics costs, and expanding demand from both food and biofuel sectors.

-

Meat exporters face higher compliance costs but earn greater margins and access to premium markets.

In essence, while edible oil export thrives on efficiency and scalability, meat export succeeds through quality assurance, traceability, and consumer trust.

The future belongs to exporters who blend sustainability, compliance, and innovation — bridging both industries in a dynamic global trade environment.